By Gustavo Ferreira and Jamie Critelli

Photo: United States Agency for International Development agricultural support to Ukraine.

Despite multiple diplomatic efforts to defuse a conflict, the international community is growingly concerned about Russian military forces moving across the Ukrainian border. Nevertheless, it remains unclear what Russian aggression would look like as it could range from unconventional warfare (e.g., cyber and paramilitary tactics) to a full-scale military operation. This paper assesses the possible impacts that a Russian occupation of significant shares of Ukraine’s territory would have on local and international agricultural markets and food security in the region. This focus on agriculture derives from the fact that Ukraine is a major global food supplier, and farming is a preeminent sector in that nation’s economy. Furthermore, when combined, Russia and Ukraine account for a quarter of global grain exports. Therefore, an armed conflict in the region coupled with increased economic sanctions will: (1) disrupt food production trade in the region; (2) further tighten global stocks of certain vital commodities such as wheat or sunflower; and (3) would exacerbate global food inflation. In fact, commodity prices have already been on the rise since the beginning of this year, and global commodity markets are closely monitoring the situation in Ukraine. After all, global wheat prices spiked following the annexation of Crimea, despite the modest agricultural output of that region and the absence of major disruptions to the trade of that commodity [1].

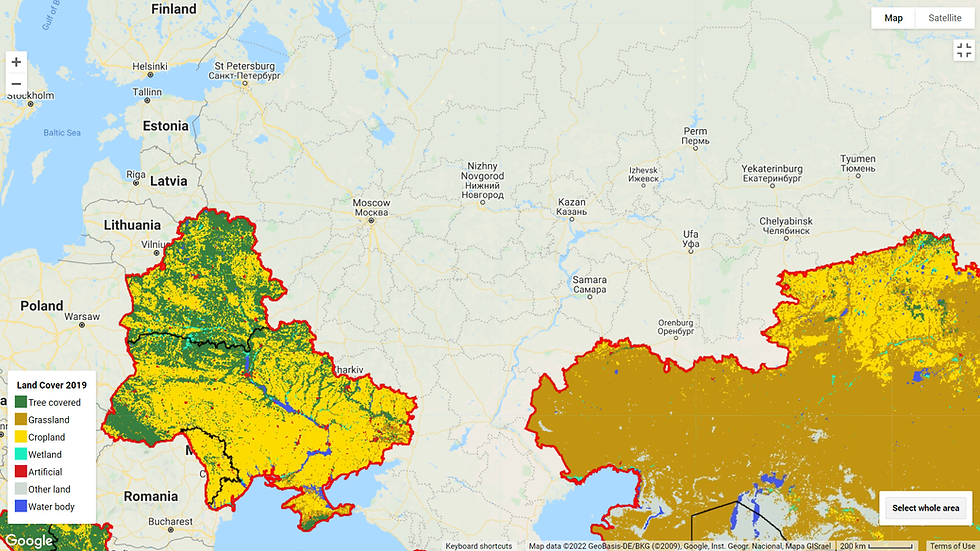

Historically, Ukraine has been coined as “the breadbasket of Europe” and is endowed with nearly 25 percent of the world’s “Chernozem” - a black soil that is very fertile and capable of producing high agricultural yields [2]. Figure 1 shows how cropland is evenly distributed and accounts for a large share of the country’s territory – about 70 percent [3].

Figure 1. Land Cover in Ukraine by use in 2019.

However, there are rising concerns about a decline in land productivity due to decades of unsustainable agricultural practices and military conflict – as will be later discussed—Figure 2 highlights how declining land productivity is mainly concentrated in the eastern and south-central regions of Ukraine.

Figure 2. Land productivity dynamics in Ukraine from 2001 to 2020.

Nevertheless, agriculture remains a major contributor to Ukraine’s overall economy and, it generated over 9 percent of its GDP. The ongoing land reform and farming equipment modernization efforts will likely strengthen this sector and allow it to approach its full potential in the near future [4]. Ukrainian agriculture is dominated by crop farming which accounts for 73 percent of the nation’s agricultural output. Grain crops (i.e., wheat, corn, barley, and rye) are the leading commodities, followed by oilseeds (i.e., sunflower, soy, and rapeseed). Other less important farming sectors include poultry, potatoes, sugar beets, and other specialty crops [5]. Agriculture is also Ukraine’s largest export industry, and with $22.2 billion worth of exports, agriculture accounted for 45 percent of Ukraine’s total export revenues in 2020. Top export products include corn, sunflower oil, wheat, soybeans, and rapeseeds [6]. The following section will discuss how an armed conflict in the region would impact agricultural production and food security in Ukraine as well as global food markets.

Impacts on Local Agriculture and Food Security

Local agriculture

Measuring the impact of a military conflict on Ukraine’s food production and food security is based on a key assumption. This assumption is that Russian troops will invade and occupy all Ukrainian regions (Oblasts) east of the Dnipro River, except for Kiev. These include Chernihiv, Sumy, Poltava, Kharkiv, Luhansk, Donetsk, half of Dnipropetrovsk, Zaporizhia, and ¾ of Kherson (see Figure 3).

Figure 3. Area of Ukraine assumed to be occupied by Russian armed forces.

Using data from the U.S. Department of Agriculture on crop production shares of all different Ukrainian regions (see appendix), it is estimated that a Russian occupation of all eastern Ukraine would significantly negatively impact local food production. Table 1 shows projected losses of more than 40 percent of the national output for sunflower, wheat, and corn – all key commodities sold mostly for animal feed and export markets.

Table 1. Estimated decreases in Ukraine's agricultural production. Source: Author's estimations based on USDA data.

Food Security

Despite Ukraine mainly being a net exporter of grains and oilseeds and self-sufficient in protein production (i.e., beef, chicken, and pork), this country ranked 58th in the 2021 Global Food Security Index - just below Morocco (57th) and above Paraguay (59th) [7]. This lackluster score reflects the conflict in Donetsk and Luhansk regions, which has been raging since 2014. This is because conflict-affected areas saw great economic disruptions, large-scale population displacement, destruction of infrastructure, and a decrease in food production. As a result, there are 1.5 million people in need in Eastern Ukraine, as well as severe issues of food insecurity. This population has been relying on international humanitarian aid, although this assistance has been severely constrained in areas not controlled by the Ukrainian government [8]. The situation in these two Oblasts should serve as a cautionary tale to what could happen if the proposed scenario materializes - Russian forces occupy all of Ukraine’s territory east of the Dnipro River.

The conflict has severely reduced food production and trade in the eastern parts of Donetsk and Luhansk. Since the conflict onset, a recent study used satellite imagery to assess cropland losses in those two regions. Results show a 22 percent loss in cropland in areas not under Ukrainian government control and a 46 percent loss in the so-called contact zone (aka front line) [9]. In the event of a Russian occupation causing similar disruptions to agricultural production in half of Ukraine’s territory, there will be grave economic shocks, massive population displacements, and calamitous levels of food insecurity.

Impacts on International Agricultural Markets

Over the years, Ukraine emerged as a major trader of global grain and oilseeds and now competes with other major food producers such as the United States, Brazil, and Argentina. As Table 2 shows, Ukraine is the world’s leading exporter of sunflower oil, exporting it to 160 countries worldwide [10]. Ukraine is also a top-five global exporter of wheat, barley, rapeseed, and corn, and key export markets include East and Southeast Asia (with China as the primary buyer), Africa, the Middle East, and Europe [11].

Table 2. Ukraine's projected share of global commodity exports. Source: Farmdoc (6).

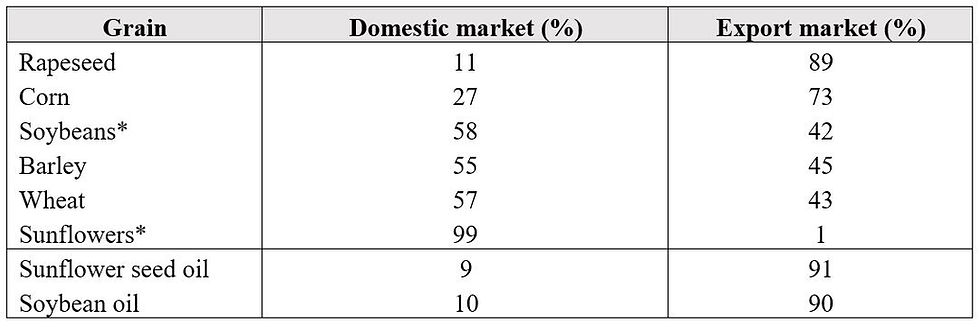

Table 3 shows the share of national crop production that is either directly exported as a commodity (e.g., rapeseed and corn) or processed domestically and then exported (e.g., sunflowers and soybeans). Note: Most of Ukrainian soybean and sunflower production goes for vegetable oil production which is then mostly exported.

Table 3. Ukraine's main crops and shares of total production for domestic and export markets. Source: U.S. Department of Agriculture.

The tight global stocks of many crops and ongoing supply chain disruptions have resulted in high food prices worldwide. The Food and Agriculture Organization (FAO) of the United Nations Food Price Index reached a 10-year high in 2021 (see Figure 4) (1). If the estimated disruptions to agricultural production in Ukraine materialize in this market environment, global agricultural commodity prices will likely increase. The resulting increase in food inflation will negatively impact countries that are heavily dependent on food imports (e.g., Egypt) as well as poor and food insecure populations. On the flip side, farmers from competing nations (e.g., United States, Brazil, etc.) would benefit from these higher prices and will eagerly strive to fill in any supply gaps left by Ukraine. Higher commodity prices would also impact global energy markets as a growing share of crop production is used to produce different fuels such as ethanol or biodiesel.

Figure 4. Food Price Index in nominal and real terms. Source: Food and Agriculture Organization of the United Nations.

Another important consideration is understanding how an armed conflict in Ukraine would impact its transportation infrastructure. According to the U.S. Department of Agriculture, 95 percent of Ukraine’s grain exports get shipped out of ports in the Black Sea. Crops produced by farms in South Ukraine travel short distances and are delivered to these export ports by truck. However, crops grown further away from the coast are transported to those same ports via railroad and river barges. According to a USDA report, in Ukraine, 68 percent of all exported grain and oilseeds are transported by rail, while truck and river account for 23 percent and 9 percent of that flow, respectively [12]. The Dnipro River is the main waterway used to move grain from the interior to Ukraine’s main exporting ports [13].

Interestingly, four ports alone account for over 90 percent of Ukraine’s total grain shipments: Mykolaiv (34 percent), Chornomorsk (25 percent), Pivdenny (18 percent), and Odessa (15 percent). As illustrated in Figure 5, only the Mariupol and Berdyansk ports, which account for merely 6.1 percent of Ukraine’s agricultural exports, would fall under our estimated Russian occupation [14]. However, it is reasonable to assume that the Russian Black Sea fleet would enforce a naval blockade to severely disrupt Ukraine’s international trade, including agricultural exports. Under such a blockade, it would be challenging for Ukraine to commercialize its agricultural crops, even those produced in areas controlled by the Ukrainian military forces (west of the Dnipro River). This is because it is unclear whether it would be logistically or economically feasible to redirect these exports to alternative inland channels. In summary, a naval blockade by Russia would deprive Ukraine of much-needed export revenues from agricultural exports and seriously undermine its financial capacity to sustain a war effort.

Figure 5. Ukraine Sea Ports.

Conclusion

With persistent supply chain issues, tight commodity stocks, and record-high food prices, it is hard to imagine a worse timing for a disruption to agricultural production in Ukraine resulting from Russian military aggression. To assess the damage that such actions would cause to local food production and food security, this article assumes that Russian armed forces invade and occupy all of Ukraine’s Oblasts east of the Dnipro River. In that scenario, it is estimated that there will be severe reductions in national crop production, with important grains and oilseeds seeing reductions of more than 40 percent. Based on observed evidence from the eastern parts of Donetsk and Luhansk, it is reasonable to anticipate the severe deterioration of food security in Oblasts occupied by Russian military forces. This, in turn, could lead to massive population dislocations as millions of people lack access to food or international aid assistance. This paper also presents another scenario in where Russian naval assets impose a blockade in the Black Sea that would gravely disrupt one of Ukraine’s main economic lifelines – agricultural exports. Lastly, disruptions to agricultural production in this region will undoubtedly impact the rest of the world via higher global commodity prices and food inflation. It is important to remember that high global food prices led to much political unrest worldwide during the food crisis of the late 2000s. Current food prices have already reached those same high levels, and in the context of supply chains still struggling to return to normalcy, a war in Ukraine could trigger a second and perhaps even more severe global food crisis.

End Notes

[1] Keith Good (2022). “Ukraine, Russia Tensions- A Growing Focus of Ag Markets,” Farm Policy News, University of Illinois.

Available at:

[2] Roman Leshchenko (2021). “Ukraine can feed the world,” Atlantic Council, Ukraine Alert, March 4, 2021.

Available at:

[3] International Trade Administration, Department of Commerce (2019). “Ukraine - Agricultural Sector,” Export.gov, August 6, 2019.

Available at:

[4] USDA Agricultural Projections to 2030. Office of the Chief Economist, World Agricultural Outlook Board, U.S. Department of Agriculture. Prepared by the Interagency Agricultural Projections Committee. Long-term Projections Report OCE-2021-1, 103 pp.

Available at:

[5] Ibid. 3

[6] Ibid. 4

[7] Sergii Skakun, Christopher O. Justice1, Nataliia Kussul, Andrii Shelestov and Mykola Lavreniuk (2019). “Satellite Data Reveal Cropland Losses in South-Eastern Ukraine Under Military Conflict,” Frontiers in Earth Science, 19 November 2019.

Available at:

[8] U.S. Agency for International Development (2019). “Food Assistance Fact Sheet – Ukraine,” September 30, 2019.

Available at:

and

2021 Global Food Security Index, The Economist Group.

Available at:

[9] Ibid.

[10] U.S. Department of Agriculture, Foreign Agricultural Service (2021). “Oilseeds and Products Annual – Ukraine,” April 05, 2021.

Available at:

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds%20and%20Products%20Annual_Kyiv_Ukraine_04-15-2021.pdf

[11] Ibid.

[12] United Nations Office for the Coordination of Humanitarian Affairs (2021). “Improving food security for families in eastern Ukraine,” Reliefweb, August 10, 2021.

Available at:

[13] U.S. Department of Agriculture, Agricultural Marketing Service (2020). “Ukraine Grain

Transportation,” Published March 17, 2020.

Available at:

[14] Ibid.

About the Authors

Captain Gustavo Ferreira is a Senior Agricultural Economist with the U.S. Department of Agriculture and serves as an Agricultural Officer (38G) at the 353d Civil Affairs Command, U.S. Army Reserves. Before joining the Federal Government, he was an Assistant Professor at Virginia Tech University’s Department of Agricultural and Applied Economics and worked as a Postdoctoral Researcher at Louisiana State University. He holds a Ph.D. in Agricultural Economics from Louisiana State University, an MBA from McNeese State University, and a bachelor’s degree in Economics from Lusiada University (Portugal).

Major Jamie Critelli is a Civil Affairs Officer serving in the 353CACOM as an Agricultural Officer (38G). He is an independent farm business owner and has worked globally in agriculture supply chain roles on five continents. He graduated with honors from Cornell University and holds a Master of Business Administration in Supply Chain Management from Eidgenössische Technische Hochschule (ETH), Zurich.

The views expressed are the authors and do not necessarily reflect the official policy or position of U.S. Army, the Department of Defense, or the U.S. Government.